A joint revocable trust is a trust that is set up for two people. It is funded with separate or common property.

A joint revocable trust can be a good option for couples whose estates are not complicated. This includes:

Almost all living will and estate planning attorneys offer a free consultation. You should take advantage of the opportunity to be well-informed about estate planning. You will have peace of mind and be on your way to an ironclad living trust package. It will help avoid probate, protect your assets, and preserve your beneficiaries’ inheritance.

A high-quality living trust package should include:

Too many people make the mistake of believing that having a will is enough to avoid probate – it is not. In California, assets exceeding $150,000 will trigger costly and time-consuming probate. And even a single asset that has not been accounted for can need probate. The laws become even stricter when real property is involved. A home left to someone thru a will alone will result in the complete probate of that will before the home can pass.

A living trust also provides a welcome layer of privacy and keeps your estate out of the court system. Huge savings can be passed on to your chosen beneficiaries. Costly attorney fees and probate costs are saved. The trust also allows for the retention of property such as a home. Having a trust avoids probate and prevents a forced sale of the home.

A living trust should also contain provisions that address your incapacity. It should provide for the protection of your estate. They can protect government-funded services through Medi-care or Med-cal. A large percentage of the elderly rely on government-funded medical benefits. Unless you have proper planning, their home can be the subject of an “estate recovery” upon their death.

A living trust should also contain provisions that address your incapacity. It should provide for the protection of your estate. They can protect government-funded services through Medi-care or Med-cal. A large percentage of the elderly rely on government-funded medical benefits. Unless you have proper planning, their home can be the subject of an “estate recovery” upon their death.

Yet another added benefit of a living trust pertains to married couples. Only a living trust can provide you with a feeling of security. After the death of the second spouse, your assets will pass to your beneficiaries. It is protected from going to some stranger you didn’t know before your death. Married couples often make huge mistakes. They think that their estate is secure for the next generation without trust in place. If the home is not in trust, then the surviving spouse can add anyone to the title they desire. Often this turns out to be a new partner in life. The surviving spouse will make another connection with a significant other. The estate is then at considerable risk of escaping generational passing. It will be subject to dilution or elimination because of the new significant other. A living trust would put the brakes on such a scenario. It will preserve the estate for the next generation.

A will by itself cannot control a disposition in the future as a living trust can. The Revocable Living Trust prevents your intentions for your estate from being violated. A will alone cannot accomplish. The trust preserves the estate for your children or other beneficiaries. Get your living trust before the inevitable happens. Iron Clad Living Wills Lawyer is the person you want to help achieve your goals in your corner.

Can I make my own living trust? Before hiring an estate planning lawyer, some look at the cheap “do-it-yourself” approach. Generic prepackaged trusts and sample estate plans are available on the internet. These assembly-line-type trusts are peddled to a mass audience. Most clients are not trained in estate planning. They do not realize that any number of scenarios can arise. If not addressed in the trust, it could result in legal warfare. It can also involve a probate court after the person’s death.

How much does it cost to set up a living trust? The cost of hiring an estate planning attorney can vary from one law firm to another. Factors in the cost include the estate’s size and whether the trust is for a married couple or a single person. Attorney fees range from $750 to $1,500 and can go higher for wealthy estates.

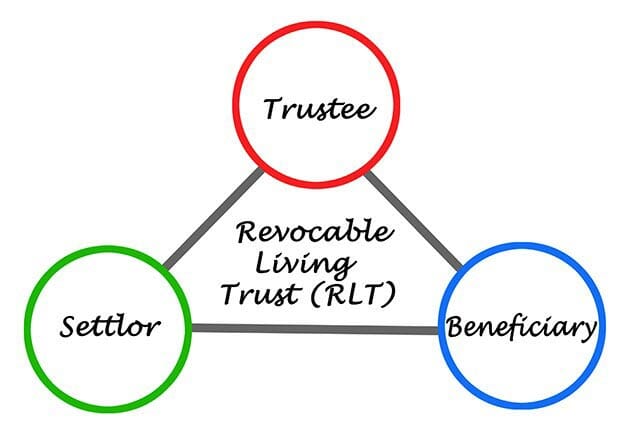

What is the purpose of a living trust? A revocable living trust has many goals. A revocable living trust is designed to avoid probate. It protects your beneficiary’s inheritance.

Which is better, a will or a living trust? A will suffers from many limitations. In California, a will cannot pass title to real property without that will be probated. A revocable living trust is the superior means for passing on your wealth. It avoids the costs and delays of probate.

Email Our Attorney Direct For Free Phone Consult & Quick Hassle Free Quote.

The use of the Internet or a form on this site for communication with the firm or any individual member of the firm does not establish an attorney-client relationship. The information you obtain at this site is not, nor is it intended to be, legal advice. We invite you to contact us and welcome your emails and phone calls. Contacting us does not create an attorney-client relationship. No attorney-client relationship exists by reason of your use of this website, as well as email exchanges or phone calls with this law firm, or legal advice provided at no charge.

Temecula | Murrieta | Menifee | Canyon Lake | Wildomar | Lake Elsinore | Winchester | Hemet | Corona | Banning | Beaumont | Fallbrook | Escondido | San Marcos | Vista | San Bernardino | Fontana | Redlands | Yucaipa | Victorville | Whitewater | Angelus Oaks | Norco | Borrego Springs | Aguanga | Cathedral City | Imperial Beach | Cedarpines Park | Palomar Mountain | Rancho Mirage | Mentone | Needles | Montclair | Thousand Palms | Sun City | Chino Hills | Oro Grande | Loma Linda | Pine Valley | Fort Irwin | Quail Valley | Palm Springs | La Quinta | Twentynine Palms | Lake Arrowhead |

Big Bear Lake | Moreno Valley | Santa Ysabel | Lemon Grove | San Luis Rey | Rancho Santa Fe | Temescal Valley | Anza | Idyllwild | Bonsall | Barstow | Phelan | Coachella